Introducing the Possibility: Can Individuals Released From Insolvency Acquire Credit Score Cards?

Comprehending the Impact of Insolvency

Upon declare insolvency, people are challenged with the considerable effects that penetrate different aspects of their financial lives. Personal bankruptcy can have an extensive effect on one's credit history score, making it challenging to gain access to credit scores or financings in the future. This financial tarnish can stick around on credit score reports for several years, impacting the person's ability to secure desirable rates of interest or economic chances. Additionally, personal bankruptcy might result in the loss of possessions, as particular ownerships may require to be liquidated to repay financial institutions. The emotional toll of insolvency must not be taken too lightly, as people may experience sensations of stress and anxiety, sense of guilt, and shame because of their financial scenario.

Furthermore, personal bankruptcy can restrict employment possibility, as some employers conduct credit score checks as component of the employing process. This can posture a barrier to people seeking new job leads or job improvements. Generally, the impact of personal bankruptcy prolongs beyond financial restraints, affecting different aspects of an individual's life.

Elements Affecting Charge Card Approval

Following bankruptcy, individuals typically have a reduced credit scores score due to the unfavorable impact of the personal bankruptcy filing. Credit score card firms generally look for a credit score that shows the candidate's ability to manage credit rating properly. By meticulously thinking about these variables and taking actions to restore credit rating post-bankruptcy, individuals can improve their leads of getting a credit card and functioning towards financial healing.

Actions to Reconstruct Credit History After Personal Bankruptcy

Restoring credit after personal bankruptcy calls for a strategic strategy concentrated on financial self-control and regular debt administration. The very first action is to examine your credit score record to guarantee all financial obligations consisted of in the personal bankruptcy are precisely mirrored. It is necessary to establish a budget that focuses on financial debt payment and living within your methods. One effective approach is to get a protected credit card, where you transfer a specific quantity as security to develop a credit line. Prompt settlements on this card can show accountable credit usage to prospective loan providers. Furthermore, take into consideration coming to be an authorized user on a family members member's bank card or checking out credit-builder finances to additional boost your credit rating. It is important to make all payments on schedule, as repayment history dramatically affects your debt rating. Persistence and perseverance are essential as reconstructing credit score takes some time, yet with commitment to sound financial practices, it is possible to enhance your creditworthiness post-bankruptcy.

Secured Vs. Unsecured Credit Report Cards

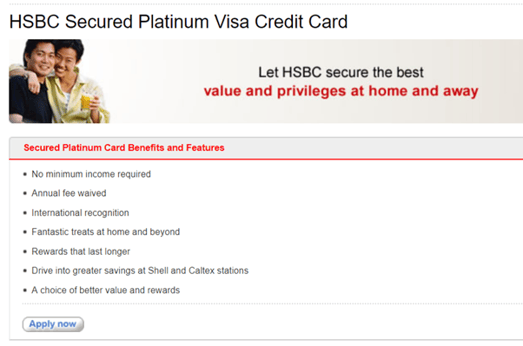

Following bankruptcy, people frequently think about the option between safeguarded and unsafe credit score cards as they intend to rebuild their creditworthiness and economic security. Protected debt cards need a cash down payment that serves as security, commonly equal to the credit score limitation that site granted. Inevitably, the option between secured and unprotected credit history cards should line up with the person's financial objectives and capacity to handle credit rating sensibly.

Resources for Individuals Seeking Credit Restoring

For individuals intending to improve their credit reliability post-bankruptcy, discovering readily available sources is crucial to effectively browsing the credit score rebuilding procedure. secured credit card singapore. One valuable resource for people seeking credit history rebuilding is credit therapy firms. These companies use financial education, budgeting assistance, and individualized credit score enhancement strategies. By collaborating with a credit therapist, people can gain insights right into their credit history records, find out approaches to increase their credit history, and receive assistance on you could look here handling their funds successfully.

One more helpful resource is credit tracking services. These solutions permit people to maintain a close eye on their debt records, track any type of adjustments or inaccuracies, and spot possible signs of identity burglary. By monitoring their credit score routinely, individuals can proactively address any type of concerns that might develop and make sure that their credit score information is up to day and precise.

Moreover, online tools and sources such as credit rating rating simulators, budgeting applications, and monetary literacy sites can provide individuals with useful details and tools to assist them in their debt restoring trip. secured credit card singapore. By leveraging these resources successfully, individuals released from personal bankruptcy can take purposeful actions in the direction of improving their credit rating health and wellness and safeguarding a better economic future

Conclusion

Finally, people discharged from bankruptcy might have the opportunity to obtain bank card by taking actions to reconstruct their credit score. Factors such as credit history earnings, history, and debt-to-income proportion play a considerable duty in bank card authorization. By recognizing the effect of insolvency, picking in between secured and unsafe credit score cards, and making use of resources for credit report rebuilding, individuals can boost their credit reliability and possibly get access to debt cards.

By functioning with a debt counselor, people can gain understandings right into their credit scores reports, discover techniques to boost their credit history scores, and obtain guidance on managing their financial resources properly. - secured credit card singapore

Comments on “How to Make best use of the Advantages of a Secured Credit Card Singapore for Financial Growth”